At Stonebridge Capital, we are convinced that we have undoubtedly entered a new macroeconomic regime, in which the traditional relationship between stocks and bonds has changed significantly. Investors should consider new approaches to asset allocation.

In our latest article on asset allocation and portfolio management, we will focus on the role that alternative investments, particularly hedge funds, can play in portfolio diversification. We will explore potential scenarios and options utilized by various investors when considering the optimization of traditional portfolios in different economic environments and cycles. Our main idea is that hedge funds and private equity can be additive to traditional investment portfolios, especially for investors concerned about inflation and/or short-term liquidity constraints not being a hindrance.

“When facts change, I change my mind.” – John M. Keynes

Change in MACRO Regime

As we indicated in the introduction, the famous 60/40 portfolio, where 60% is invested in stocks and 40% in bonds, was designed to protect investors from volatility and deliver excellent returns. The balanced portfolio enjoyed tremendous success due to the negative correlation that stocks and bonds “generally” exhibit. Stocks performed well when bonds did not, and vice versa. The success of the 60/40 portfolio was compounded by the last decade and the environment in which both stocks and bonds thrived (zero interest rates, low inflation, QE, etc.).

However, as we live in unprecedented times, particularly the threat of inflation has led to a paradigm shift. Central banks have resorted to the fastest tightening of monetary policy in the last 40 years. Last year was a nightmare for 60/40 portfolios as it generated a negative return of -17% and was the 2nd worst year in history since 1931.

For some time now, we have been asserting that we are entering a new macroeconomic regime driven primarily by non-traditional shocks, including labor shortages, high inflation, growing geopolitical tensions and debts, investment bubbles, reorganizations of the world order, and global energy transformation. Such a mix has created the most complex environment we have ever seen and experienced. In the past, we faced inflationary pressures in the 1940s and 1970s, the 2008 debt crisis in the USA, followed by the debt crisis in the eurozone, local wars of varying scales, but we have never faced a combination and complexity like today.

Real Alternative

We will focus on alternative investments as real alternatives, with a deeper dive into hedge funds and private equity, using the traditional 60/40 stocks and bonds portfolio as a reference point. Given this new environment, investors are considering pursuing two main objectives aimed at improving their asset allocation and diversification. These are, in order of importance:

1.) Increasing protection against inflation by adding additional real assets, given our view that in this cycle, the inflation rate will be higher well above the 2% target (at least 3%),

and

2.) Improving the robustness of a diversified portfolio by adding alternatives, including actively managed strategies (hedge funds) and real assets (e.g., private equity), based on our conviction that the traditional relationship between stocks and bonds, which existed or prevailed in the 60/40 portfolio and was distorted in the last decade (zero interest rates, quantitative easing, low inflation rate), has changed and we are only at the beginning of this change.

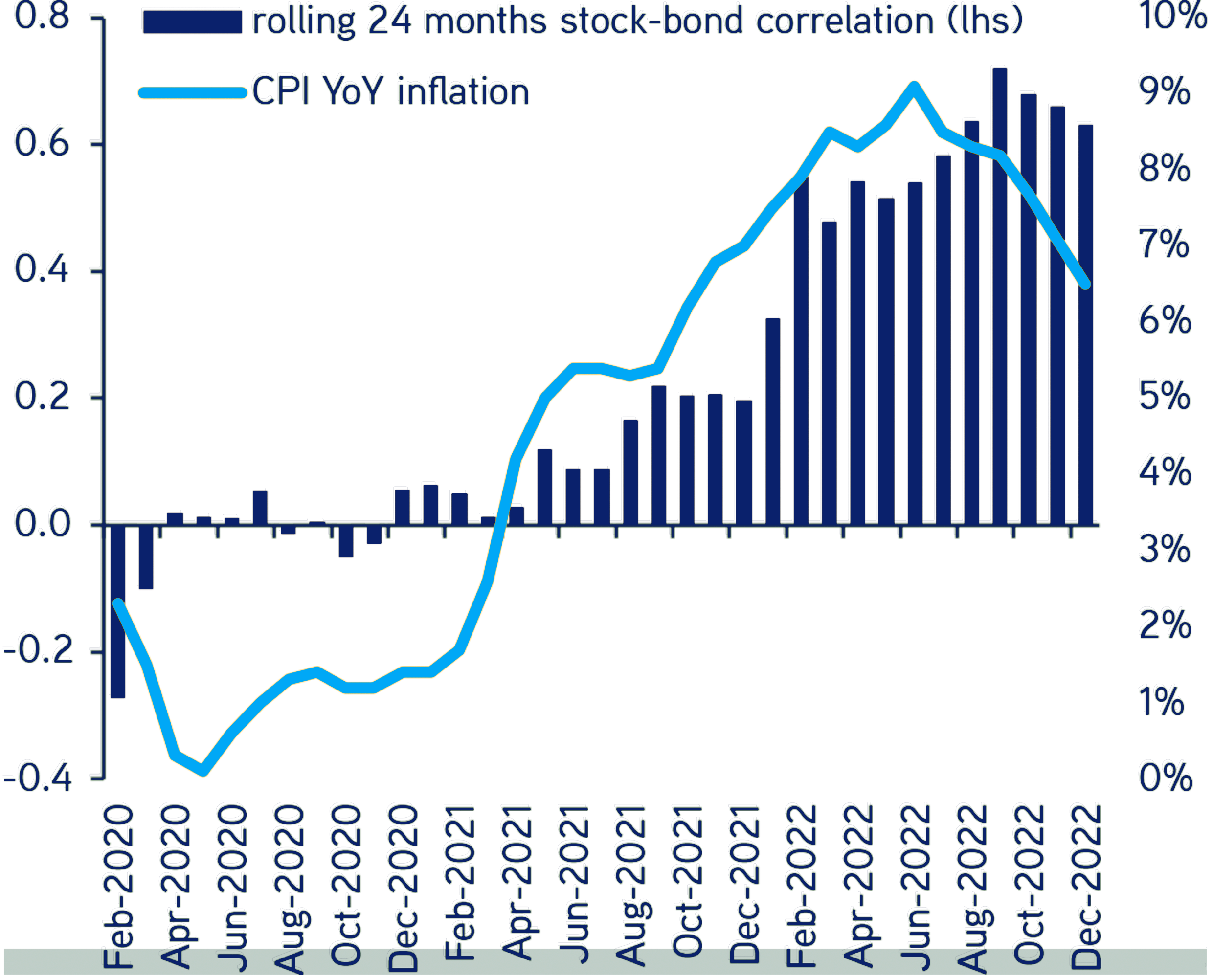

Chart No.1

The positive correlation between stocks and bonds continues to increase, a key feature of our thesis on the new regime

However, investors have become accustomed to this environment, which was characterized by the longest bull market in history, and they find it very difficult to accept the new paradigm. The only constant is change.

Source: Bloomberg, KKR a HFSBC

However, investors have become accustomed to this environment, which was characterized by the longest bull market in history, and they find it very difficult to accept the new paradigm. The only constant is change.

“Great is the power of habit.“ – Marcus Tullius Cicero, Roman philosopher and statesman, 106 – 43 BC.

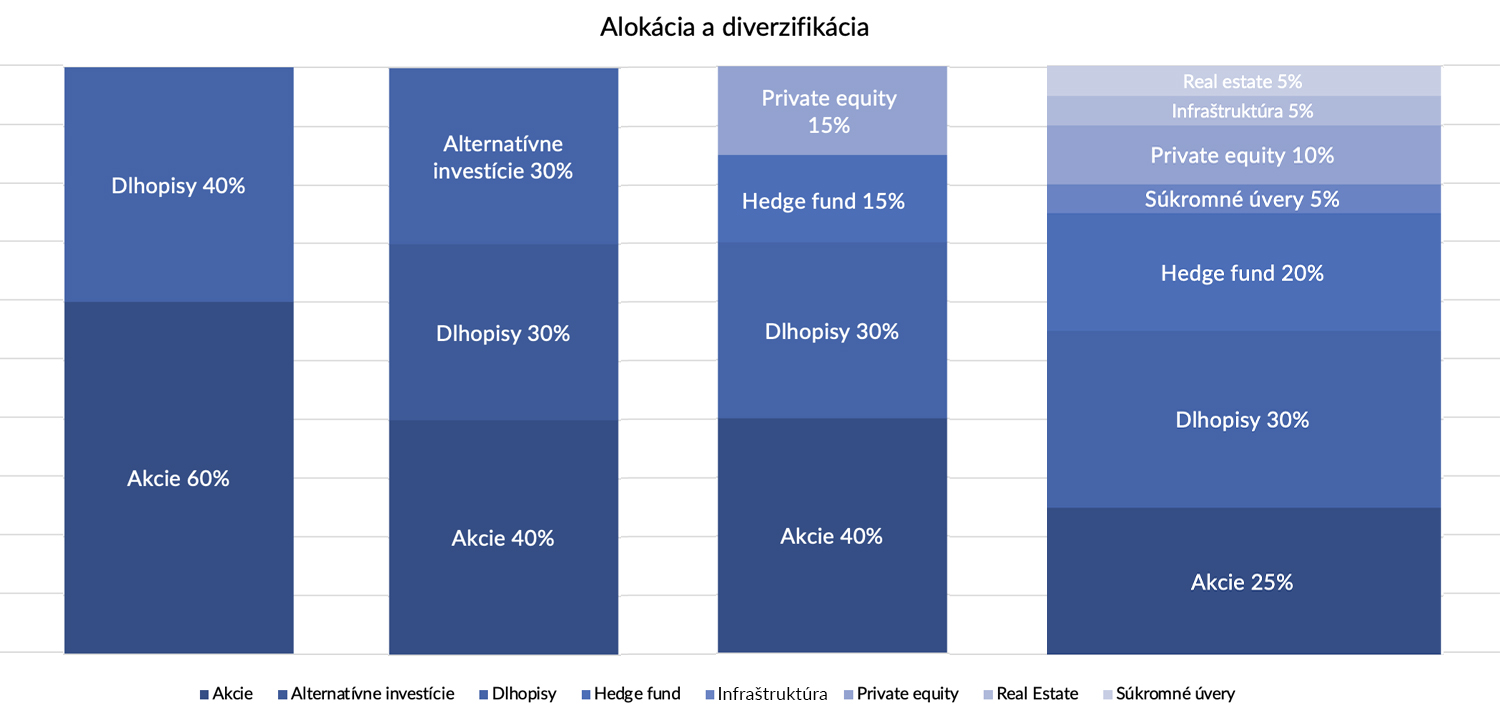

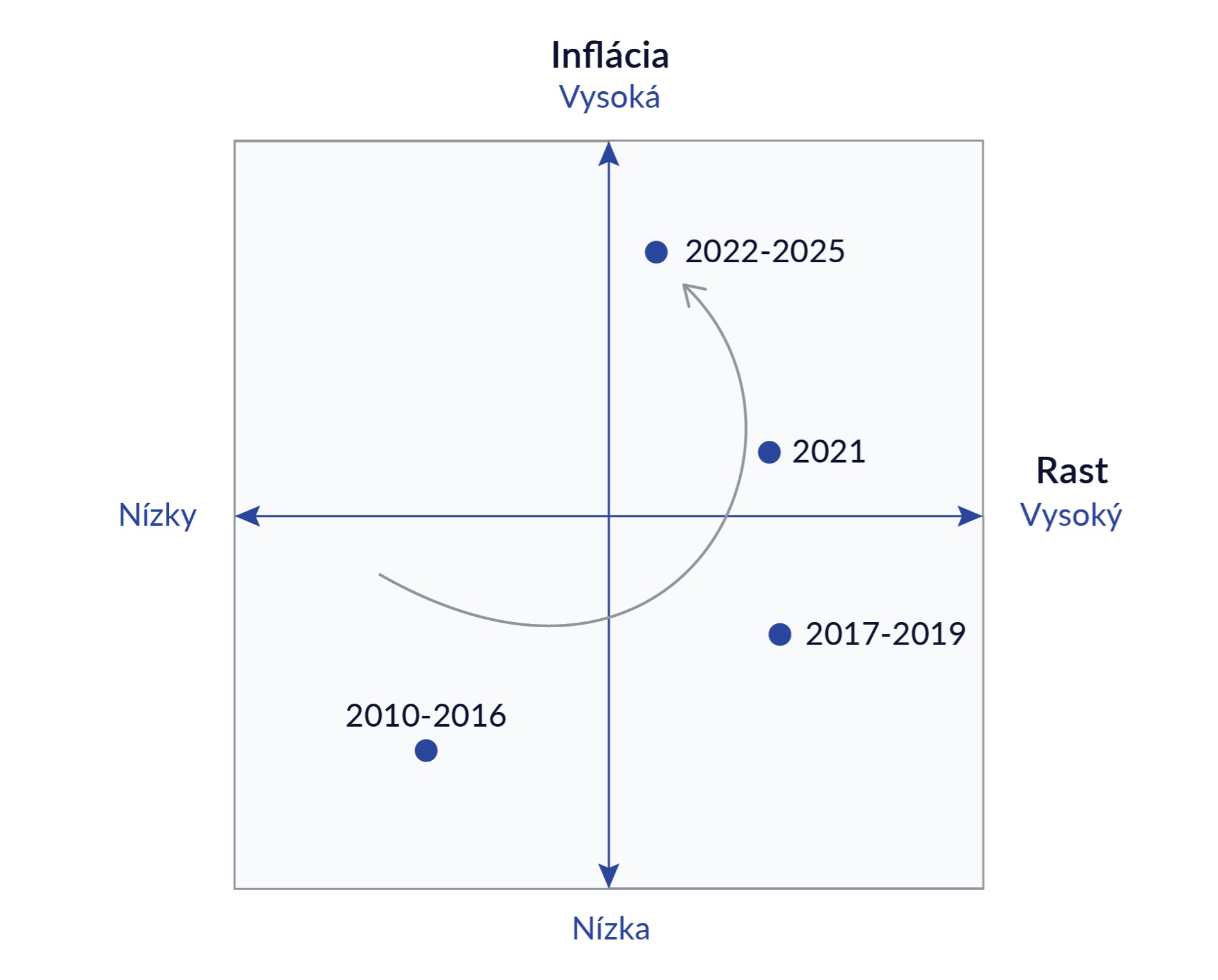

To achieve the aforementioned goals, we have proposed to investors to consider adjusting their traditional 60/40 allocation (Chart No.2, column 1) to a stylized portfolio of 40/30/30 (Chart No.2, column 2), where 30% of the allocation in alternative investments would be evenly split between private equity and actively managed strategies – hedge funds (Chart No.2, column 3). Our research confirms that if investors do not believe we are returning to an environment of low growth and low inflation (i.e., the lower left quadrant of risk, Chart No.3), the proposed 40/30/30 portfolio has the potential not only to provide better returns but also to reduce risk in most macroeconomic environments (see Chart No.5).

However, it is important to note that the proposed portfolio is generally intended for institutional and professional investors. Our investors often ask us, “how to properly allocate and diversify a portfolio to address the two priorities we mentioned above?” In general, we advise investors to first ask themselves what is most important to them, what their priorities are, because diversification, investment goals, liquidity acceptance, return, and risk tolerance are often highly individual, even among investors of the same investment weight, environment, business focus, or professional background (private, institutional), and only then can we address diversification itself.

Chart No.2

The addition of alternative investments can increase returns. When allocating to alternatives, it’s necessary to consider the benefits that various strategies can provide.

Source: KKR Portfolio Construction analysis, HFSBC

The Golden Era of Active Investing

What is the main idea behind allocations into actively managed strategies (hedge funds) and private equity? As detailed below, we remain more than optimistic in the class of alternative investments. Not in an evasive manner, as we focus on alternative investments and specifically on actively managed strategies, such as hedge and investment funds, but this thesis is confirmed in their reports and outlooks for the next decade (10 years) by the largest financial institutions including BlackRock, Vanguard, JP Morgan, and many others. While the previous decade belonged to passive investing, where “almost nothing could go wrong” also due to the macro environment we briefly described above. This decade will be the golden era of active fundamental macro investing.

However, any discussion about allocating alternative strategies into one’s portfolio involves certain compromises. For example, in the traditional segment of our business (where emphasis is often placed on short-term liquidity), investors are increasingly replacing a significant portion of their investment activities with alternative investments to capitalize on stronger returns. On the other hand, higher returns and absolute returns are expected as a premium for illiquidity. In general, hedge funds are more liquid than real estate, venture capital, or private equity, while being less liquid than ETFs or mutual funds.

Príklad nášho navrhovaného portfólia inštitucionálneho typu možno vidieť v Graf č.2, stĺpec 3, kde private equity a hedžový fond predstavuje rovnomerné zastúpenie po 15% a teda spolu tvoria jednu tretinu (30%) celkového portfólia. V súlade s investičným prístupom toto portfólio inštitucionálneho štýlu je určitým kompromisom a vychádza v ústrety alokátorom, ktorí sú ochotní vzdať sa určitej likvidity pre potenciálne vyššie dlhodobé výnosy, nie však úplne.

Chart No.3

Risk Quadrant. While the year 2023 is expected to be an environment with lower inflation, we believe there has been a regime change. Data as of November 30, 2023.

Source: KKR, HFSBC

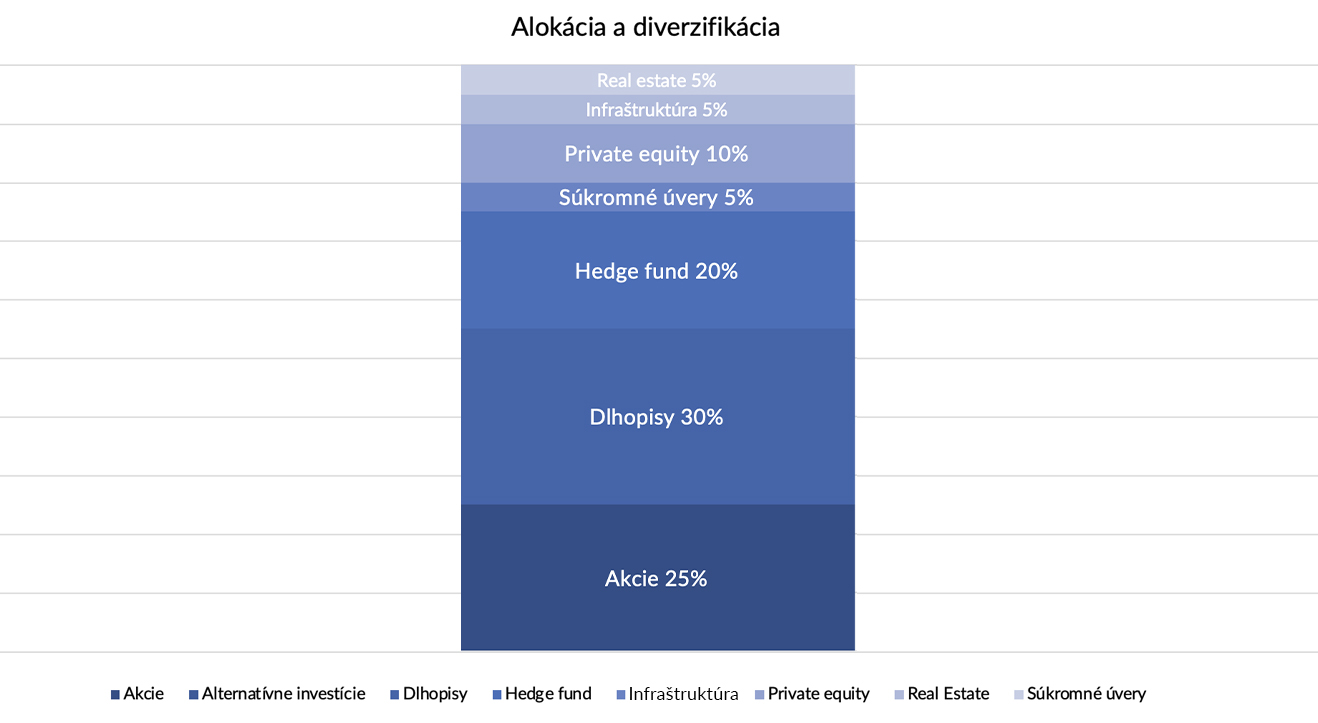

In Chart No. 4, we allocated 45% of the total allocation to alternatives (institutional portfolio without compromise), a level targeted by many established foundations, family offices, and asset managers within their asset allocation frameworks. A 45% allocation to alternatives may seem too high for those prioritizing liquidity higher in their priorities.

In the proposed portfolio, although alternatives account for “up to” 45% of the total allocation, on the other hand, we have divided it into multiple asset classes for diversification and also considered a certain level of liquidity (10% private equity, 5% infrastructure projects, 5% private loans, 5% real estate, and 20% hedge funds). Of course, there are many variations and options that could be considered or individually tailored. For example, in infrastructure projects or real estate, a high initial capital investment is required without diversification and significantly reduced liquidity.

Our goal, among other things, was primarily to create a resilient cohort capable of both offense and defense, with an emphasis on risk mitigation.

This basic framework should provide all investors with a broader perspective and enable them to better appreciate certain trade-offs between returns, liquidity, risk, and inflation protection offered by various asset classes while also emphasizing alternative investments.

When allocating to alternative investments and actively managed strategies, it’s important to consider the advantages and disadvantages of what they can provide.

Chart No.4

Allocation of 45% of the portfolio to alternative investments

Source: HFSBC

Investment Approach And Historical Perspective

Actively managed strategies generally outperform publicly traded stocks in almost all environments except the “low inflation/low growth” regime. For example, during periods of high inflation, private equity generated returns approximately +6% higher than stocks. Interestingly, the excess returns of alternative investments are actually greatest when equity markets deliver low returns.

We believe that returns will be much lower for most asset classes in the future than assumed, an environment that has often allowed actively managed investments to outperform stocks and bonds. Importantly, in all regimes we have studied over several decades, private equity has empirically delivered excess returns of approximately +4.3% on a net annual basis, with performance tending to be consistently better in tougher market environments. It is true that, for example, in a purely inflationary regime, commodities were the best asset class both nominally and absolutely (active strategies were not compared). However, commodity futures contracts have one major disadvantage, which does not allow investors to play the long game. We recommend learning more about this topic in our series of analyses on inflation. Given that we anticipate higher inflation in the coming years, we believe investors should protect their purchasing power and capital by diversifying their portfolios to include more alternative investments and assets.

“Investors and companies tend to utilize alternative investments more in the context of tightening financial conditions, which is clearly the environment we are currently in.”

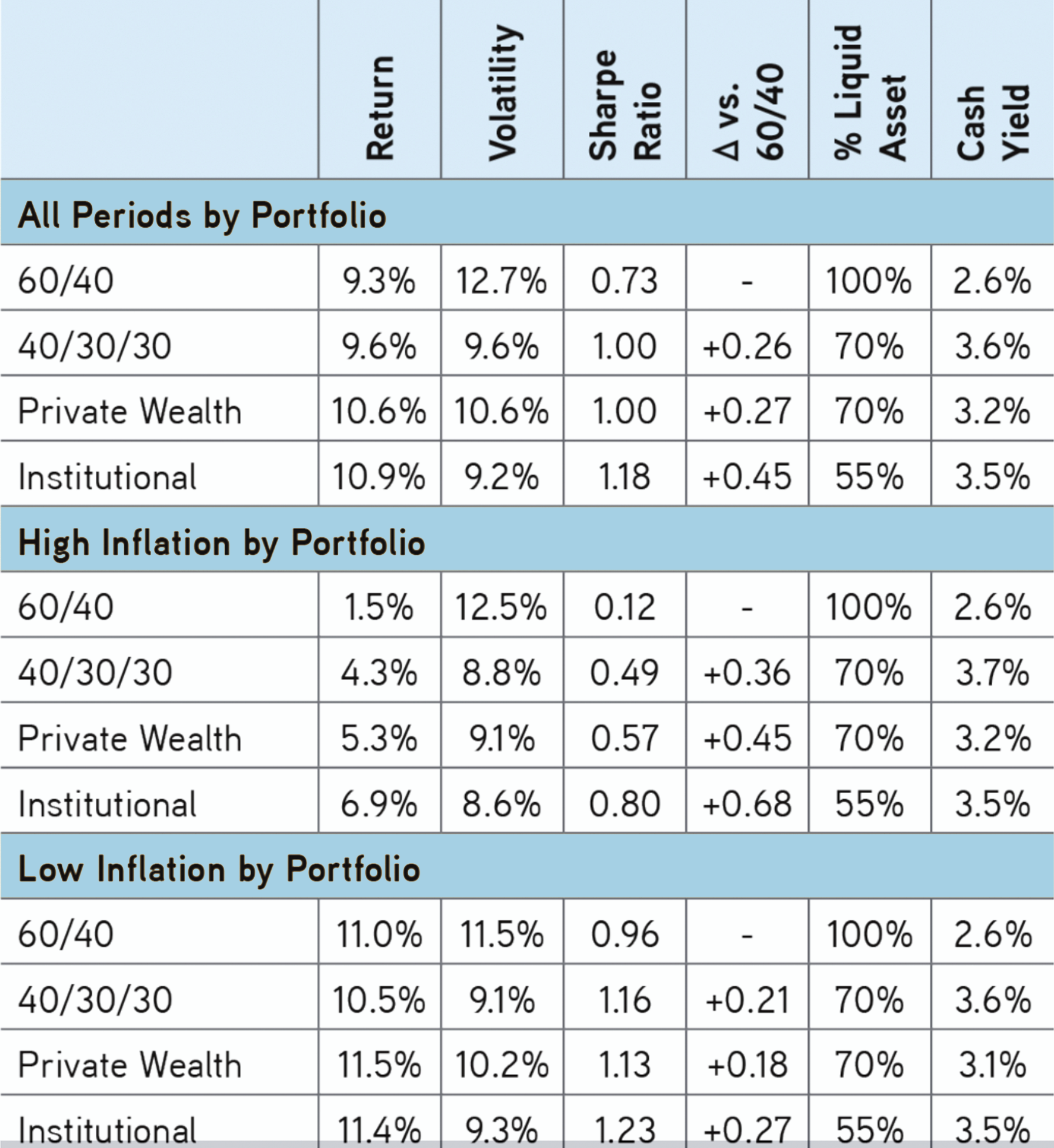

Chart No.5

Based on historical returns, adding Alternatives to portfolios can often help achieve better risk-adjusted performance

Source: HFSBC, KKR, Burgiss, Aswath Damodaran, Bloomberg, NCREIF

Portfolio returns and volatility modeled using total annual returns from 1928 to 2021 for the S&P 500, from 1978 to 2021 for real estate, from 2004 to 2021 for infrastructure, from 1928 to 2021 for bonds, from 1928 to 1987 and 2021 for private credit. Assumes ongoing portfolio rebalancing. U.S. stocks modeled using the S&P 500 index. Bonds modeled using a combination of 50% U.S. government bonds and 50% Baa Corp. bond annual returns, historically calculated by Aswath Damodaran (NYU Stern). Real estate modeled using the NCREIF Property Levered Index. Private infrastructure modeled using the Burgiss Infrastructure Index. Private Equity modeled using the Buriss North America Buyout Index. Private Credit modeled using the Burgiss Private Credit All Index. Cash returns modeled using annual data from 2000 to 2021 for all asset classes except private real estate (2005-2021), Public Equity using S&P 500 12M gross dividend yield, Private Equity proxied using S&P Small Cap 12M gross dividend yield, Private Infra proxied using S&P Infrastructure 12M gross dividend yield from 2006 and backfilled from 2000-2006 using S&P Utilities, Public Credit based on Bloomberg aggregated worst-case credit yield, Private Credit based on Cliffwater Direct Lending Index income return, Private Real Estate based on NCREIF NPI unlevered rate of return.

What is the main added value for investors allocating actively managed strategies into their portfolios?

First and foremost, it’s about an extraordinary level of diversification and low correlation. To truly diversify, you need alternatives. And that’s achieved through a combination of multiple investment styles. Because alternative portfolios are driven by different investment conditions, they function precisely when other strategies fail.

The disadvantage of actively managed strategies, but this applies to other investments as well, is knowing the qualities of the manager and the fund, because there’s certainly no one-size-fits-all measure that every alternative investment or strategy is successful.

The second undeniable advantage is the principle of absolute returns (achieving positive returns under all market conditions). For example, in a year when global stocks fell by more than -20% and bonds by -16.7%, multi-strategy hedge funds averaged a gain of +9.5%. The five-year performance for hedge funds now stands at a CAR of +4.2%, comfortably outperforming bonds (-2.0%) and slightly outpacing stocks (+3.0%).

Investors should closely monitor developments because history teaches us that such an environment leads to increased volatility in stocks and bonds, but also generates exceptional opportunities.

Author: Martin Pitoňák, CEO Stonebridge Capital