If you still remember the Great Financial Crisis of 2008, the European Debt Crisis in 2011, or the significant downturns during COVID-19 (March 2020), you might have encountered the term CDS or Credit Default Swaps. Since this is not a standard financial instrument like stocks or bonds, I decided to introduce you to this interesting derivative.

Before we define it, it is important to note that it is a security issued almost tailor-made and is primarily intended for financial institutions such as hedge funds. Ordinary investors cannot come into contact with them for several reasons, which we will gradually explain in a series of articles on this topic.

Definition

CDS is the most commonly used type of credit derivative. In its most basic terms, a CDS is similar to an insurance contract and provides the buyer with protection against specific market risks. Investors most often purchase credit default swaps to protect against defaults.

In a CDS, one party “sells” the risk and the counterparty “buys” this risk. The “seller” of credit risk—who also tends to own the underlying credit asset—pays the risk “buyer” a regular fee. In return, the risk “buyer” agrees to pay the “seller” a specified amount if the credit event in question occurs. CDS are designed to cover many risks, including institution defaults, bankruptcies, credit rating downgrades, or market declines.

CDS Transaction

Risk “seller” = protection “buyer”

Risk “buyer” = protection “seller”

Parties Involved in a CDS Transaction

Minimum of 3 parties:

a/ BORROWER – the institution that issued the debt security (loan)

b/ CDS BUYER – the buyer of receivables

c/ CDS SELLER – most often a large investment bank or insurance company that guarantees the underlying debt between the first and second parties

Option to Switch Sides

For example, if the CDS seller believes that the borrower is likely to default, the CDS seller may buy its own CDS from another institution or sell the contract to another bank to offset the risks.

Settlement of CDS is either by cash settlement or physical settlement. In cash settlement, the price is determined by asking dealers and the mid-market value of the reference obligation is used for settlement.

A CDS can be structured for either a principal shortfall or an interest shortfall.

There are three options for calculating the amount of the seller’s payment to the buyer:

a/ Fixed Cap: The maximum amount a protection vendor will pay is a fixed rate.

b/ Variable Cap: the protection seller compensates the buyer for any loss of interest and the cap is Libor plus a fixed salary.

c/ No cap: In this case, the protection vendor must compensate for the loss of interest without any cap.

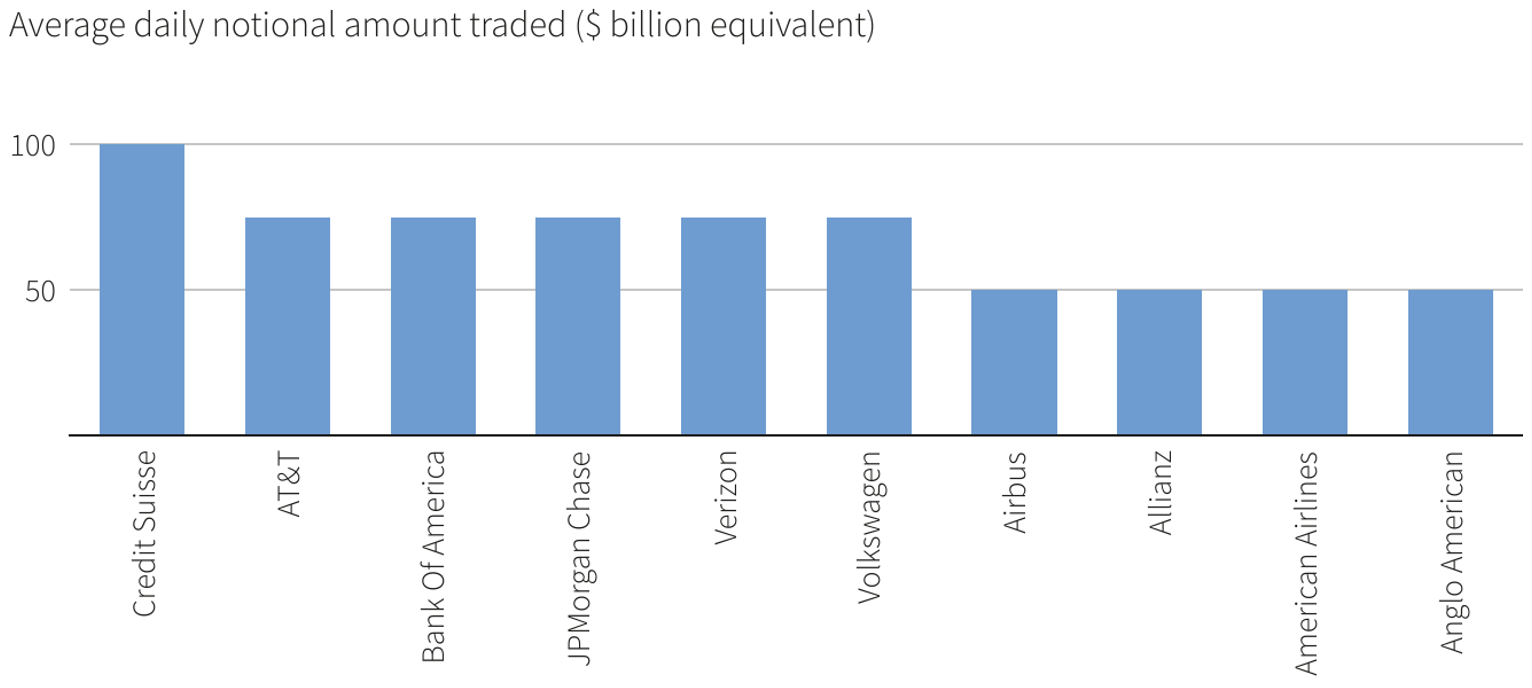

Chart No.1

The CDS market is not that big.

As of December 2022

Source: DTCC/Reuters Amanda Cooper

Most of these swaps protect high-risk municipal bonds, government bonds or corporate bonds from default. They are also used by investors to protect against the credit risk of mortgage-backed securities, collateralised debt obligations and subordinated bonds, known as junk bonds. These are high-risk, high-yield bonds with poor or very poor credit ratings. It was these CDSs that played a major role during the financial crisis, which mainly benefited hedge funds and which you saw in the legendary film The Big Short.

The Main Advantages and Risks of CDs

Advantages

- Delivery: The buyer has the option to deliver a bond of any value and receive the face value.

- Issuance of new bonds: Increases demand for insurance, leading to higher cost of protection.

- Short Sale Ability: If the issuer’s creditworthiness deteriorates, CDS spreads react more quickly when demand for insurance increases. Again, the same rule as for options applies. Insurance is cheap and needs to be bought before the house is on fire.

- Repo specialty: Agreements to repurchase certain bonds whose yield will increase the value of CDS spreads and the bonds as such will not be available.

Risks:

- Counterparty Risk: A premium to compensate for the risk of protection vendor failure.

- Bond illiquidity: Although the effect may be ambiguous, an illiquid security usually trades at higher spreads and therefore reduces the relevant basis.

- Funding Risk: The protection seller does not take on funding risk as it would in a swap replication by purchasing the underlying asset with funds borrowed at a risk-free rate.

Use of CDS

Investors may buy credit default swaps for the following reasons:

1.) Speculation

An investor may buy or sell a credit default swap on an entity believing that it is priced too low or too high and try to profit from it by entering into the trade. An investor may also buy credit default swap protection to speculate that a company is likely to go bankrupt because an increase in the CDS spread reflects a decline in creditworthiness and vice versa.

The buyer of a CDS can also sell its risk if it thinks the seller’s creditworthiness might improve. The seller is considered to be long the CDS and the loan, while the investor who bought the protection is seen as short the CDS and the loan. Most investors argue that the CDS helps in determining the creditworthiness of an entity.

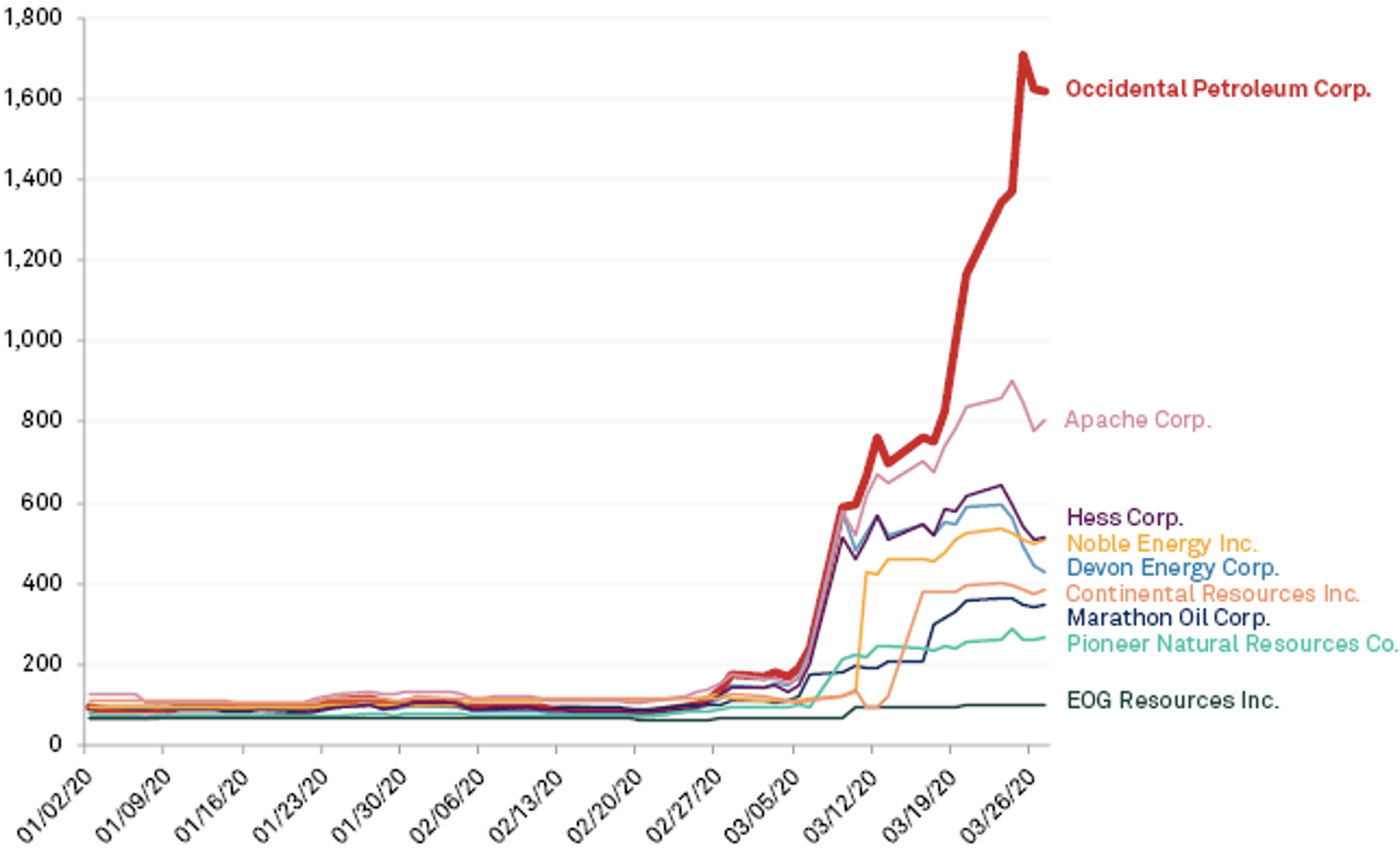

Chart No.2

CDS with energy companies during the COVID-19 pandemic

Source: S&P Global Market Intelligence

2.) Arbitrage

Arbitrage is the practice of buying a security from one market and simultaneously selling it in another market at a relatively higher price, thereby taking advantage of a temporary difference in prices. It relies on the fact that the spread between the share price and the firm’s credit default swaps should exhibit a negative correlation. If the company’s outlook improves, the stock price should increase and the CDS spread should decrease. However, if the company’s outlook does not improve, the CDS spread should widen and the stock price should fall. For example, if a company experiences an adverse event and its share price declines, an investor would expect the CDS spread to increase relative to the decline in the share price. Arbitrage can occur when an investor takes advantage of market sluggishness to profit.

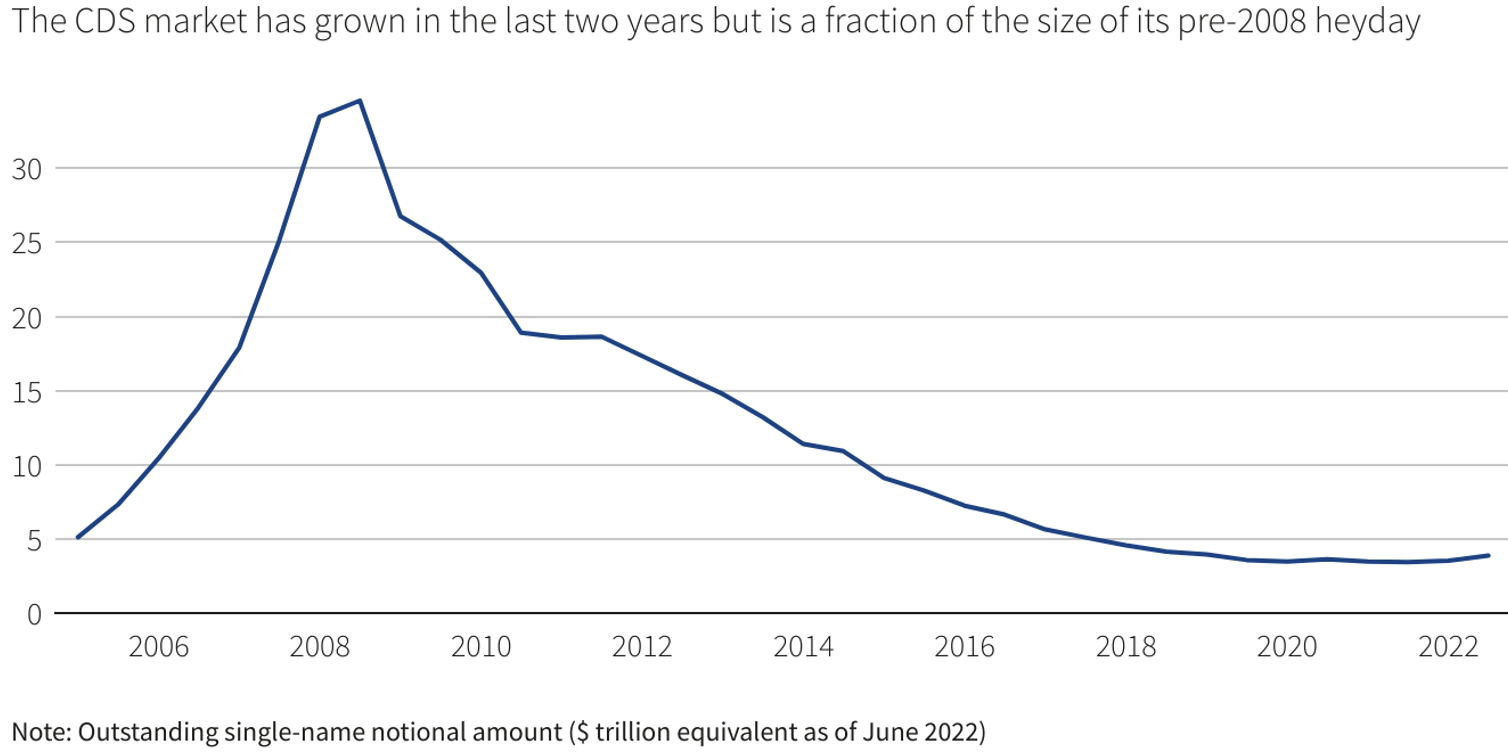

Chart No.3

CDS development. We see that as risk and volatility increase, the value of CDS contracts increases.

Source: DTCC Reuters – Amanda Cooper

3.) Hedging

Hedging is an investment aimed at reducing the risk of adverse price movements. Banks can hedge against the risk, i.e. that the borrower defaults, by entering into a CDS contract as a protection buyer. If the borrower defaults, the proceeds of the contract are offset against the outstanding debt. If the CDS does not exist, the bank can sell the loan to another bank or financial institution.

However, this practice can damage the relationship between the bank and the borrower because it shows that the bank does not trust the borrower. Buying a credit default swap allows the bank to manage the risk of default while retaining the loan as part of its portfolio.

A bank may also use hedging as a way of managing concentration risk. Concentration risk arises when a single borrower represents a significant percentage of the bank’s borrowers. If that one borrower defaults, it will be a huge loss for the bank.

The bank can manage the risk by buying CDS. Entering into a CDS contract allows the bank to achieve its diversity objectives without harming its relationship with the borrower, as the borrower is not a party to the CDS contract. Although CDS hedging is most prevalent among banks, other institutions such as pension funds, insurance companies and corporate bond holders may purchase CDS for similar purposes.

Similarly, hedge funds use credit default swaps as a risk management tool, capital protection or as a form of sophisticated investment with clearly defined risk.

Author: Martin Pitoňák, CEO Stonebridge Capital